The Big Ugly Betrayal: The Big Ways It Will Hurt Hoosiers

Ripping Hoosier families off isn't beautiful.

Dear neighbor,

On July 4, President Trump signed the "One Big Beautiful Bill,” also called the Big Ugly Betrayal (BUB), into law. The spending package includes cuts to Medicaid, changes to student loans, the end of clean energy programs and more. Some portions of the bill will go into effect later this year, but some changes won’t be implemented until 2026 or as late as 2028.

It doesn’t matter where you live, where you work or how much money you make — this bill will impact you. Indiana is the third most reliant state on federal funding. We’re going to lose hundreds of millions of dollars that support Hoosiers. Utility bills will increase. Rural hospitals and nursing homes will close. Students will struggle to afford college. Thousands of Hoosiers could get kicked off their health care or SNAP assistance. Here’s an in-depth look at some of the biggest impacts for Hoosiers:

Medicaid & Medicare:

Indiana will lose $23 billion: The passed megabill will reduce federal spending on Medicaid and the Children’s Health Insurance Program (CHIP) by $1.02 trillion nationwide. Indiana will lose $23 billion in Medicaid funding over the next 10 years. This will drastically affect the quality of care and the number of programs our Medicaid program offers. Fewer dollars mean fewer services. Sadly, it’s usually the smaller programs or more expensive services that are impacted first. We saw this happen last year with cuts to at-home care for our elderly and disabled children.

Over 200,000 Hoosiers could lose their health care: The BUB makes changes to eligibility and adds additional income and residency verifications. Indiana Republicans also passed SEA 2 this session, which creates state work requirements for Medicaid, even though the majority of Hoosiers on Medicaid are working. Over 200,000 Hoosiers are at risk of losing their health care coverage due to changing eligibility and increased paperwork. Down the road, the future of the Healthy Indiana Plan (HIP) is seriously at risk because of funding cuts. There will also be new out-of-pocket costs, such as premiums and copayments for enrollees. A family making $33,000 could be on the hook for $1,650 in new costs.

Rural hospitals and nursing homes will close: Rural hospitals have the lowest operating margins in the nation, meaning that any reduction in funding will close their doors. Around 44% of rural hospitals in the U.S. are operating in the negative. 12 hospitals in Indiana are at risk of closure due to the BUB. A recent study by Brown University’s School of Public Health found that almost 600 nursing homes across the U.S. could close. Once again, fewer dollars mean fewer services, especially in rural areas.

Potential Medicare cuts: The BUB stops the implementation of two new regulations for Medicare. The regulations would have made it easier for low-income Medicare enrollees to access Medicare Savings Programs (MSPs). These programs help cover costs for disabled individuals since they usually have higher health care bills. In addition, if Congress doesn’t increase revenue or reduce spending, the BUB could trigger a $490 billion cut to Medicare. Medicare is an “entitlement program,” meaning it’s on the chopping block if Congress spends more than it makes (called the Pay-As-You-Go-Rule).

You can read about the Medicaid and Medicare impacts at this link. Also, check out this Indiana Medicaid fact sheet.

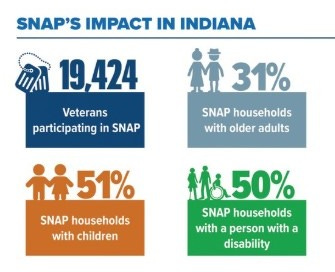

SNAP:

Families lose assistance: The Supplement Nutrition Assistance Program (SNAP) serves 588,184 Hoosiers. Indiana currently spends $97 million on SNAP, but federal cuts will increase our cost to $146 million. Indiana can’t afford such a large increase, meaning families will lose their benefits. The president and CEO of the Gleaners Food Bank of Indiana warned that these changes would create “a needless self-inflicted humanitarian and economic disaster for Indiana.”

Here’s a table from the Center for American Progress (CAP) that illustrates the impact of cuts to SNAP on each congressional district.

K-12 Education

Creates a nationwide voucher program: Similar to what we have in Indiana, the BUB creates a federal private school voucher program. Called Qualified Elementary and Secondary Education Scholarships, each taxpayer can get $1,700 towards private school tuition through a tax shelter. There is no cap on the money spent on this program, creating a significant potential cost to the federal budget. Since this is just a fraction of private school tuition, this will cut costs for wealthier families while doing little to expand access to lower-income students. This means both state and federal dollars will be diverted from our traditional public schools to private institutions.

Fewer services for students with special needs: Medicaid is the third-largest source of funding for K-12 public schools and funds nearly 30% of early intervention for infants and toddlers with disabilities. Cuts to Medicaid funding mean schools will struggle to get reimbursed for services and supplies for special needs students.

SNAP cuts impact students’ free meals: The changing eligibility requirements for SNAP and Medicaid will impact students’ free or reduced lunch. These programs are used to determine a child’s eligibility for free meals. A family losing their assistance could mean they no longer get free or reduced lunches.

Tax Cuts Fail to Prioritize Working Families

Middle-class gets a small break: To be considered middle-class in Indiana, a household makes a yearly income between $45,000 and $134,000. Close to half of Indiana’s households fall in this range. The BUB’s tax breaks will provide middle-class households with savings ranging from $500 to $1,700.

Our struggling families pay more: Indiana’s families with the lowest incomes will lose about $1,600 a year. They receive little to no tax breaks, and in some instances, their income taxes could actually increase. They’ll also experience higher costs as they pay more out of pocket for groceries and health care.

The wealthy are the winners: America’s wealthy get the best deal since the top 10% will receive 68% of the BUB’s tax benefits. A family making $700,000 per year will get a $12,000 boost in their income.

More information is available at the Tax Foundation.

Energy and Utilities:

Raising your bills: The BUB eliminates incentives for utility companies to use solar and wind power. Power companies will cancel renewable energy projects and move back to fossil fuels. But the prices of coal and natural gas are climbing due to dwindling supply. Utility companies will spend more on fossil fuels to generate power, then pass those increased costs off onto consumers. Households will see an annual increase of $337 on their utility bills as early as next year.

Ends tax breaks for energy-efficient homes: Homeowners who made their homes more energy-efficient through rooftop solar, electric heat pumps previously received a tax credit for using clean energy. This tax credit has been repealed, signaling the national shift back to fossil fuels. This provision expires at the end of 2025.

Student Loans:

Caps graduate loans and Pell Grants: Student borrowers attending graduate school will have a lifetime loan cap of $100,000. Medical and law students will have a lifetime loan cap of $200,000. Grad PLUS loans were eliminated. However, these caps fail to cover the full cost of schooling, especially for out-of-state tuition. The median cost for four years at a public, in-state medical school is $268,476. More graduate students will rely on private student loans, which often have higher interest rates and less flexible repayment plans. The bill also changes the eligibility for Pell Grant awards, impacting lower-income students.

Worsens professional shortages: By making it harder to get loans for graduate school, fewer students will attend. This could worsen professional job shortages. Indiana is experiencing a wide range of shortages, including attorneys, doctors, nurses and teachers.

Changes to repayment plans: The BUB eliminates roughly a dozen current repayment plans, including SAVE and PAYE. Repayment plans will be consolidated into only two options: the income-based Repayment Assistance Plan (RAP) and a standard, fixed payment plan. Under RAP, most borrowers will see increases in their monthly payments. A typical student loan borrower will see a $2,929 increase per year on their payments.

Deferment and forbearance: The BUB also eliminates deferments, pauses on payments and interest accrual, if a borrower becomes unemployed or experiences financial strain. Borrowers can still be in forbearance, where payments are paused, but interest still accrues. But the period borrowers can be in forbearance is lowered from a year to only nine months.

National Debt:

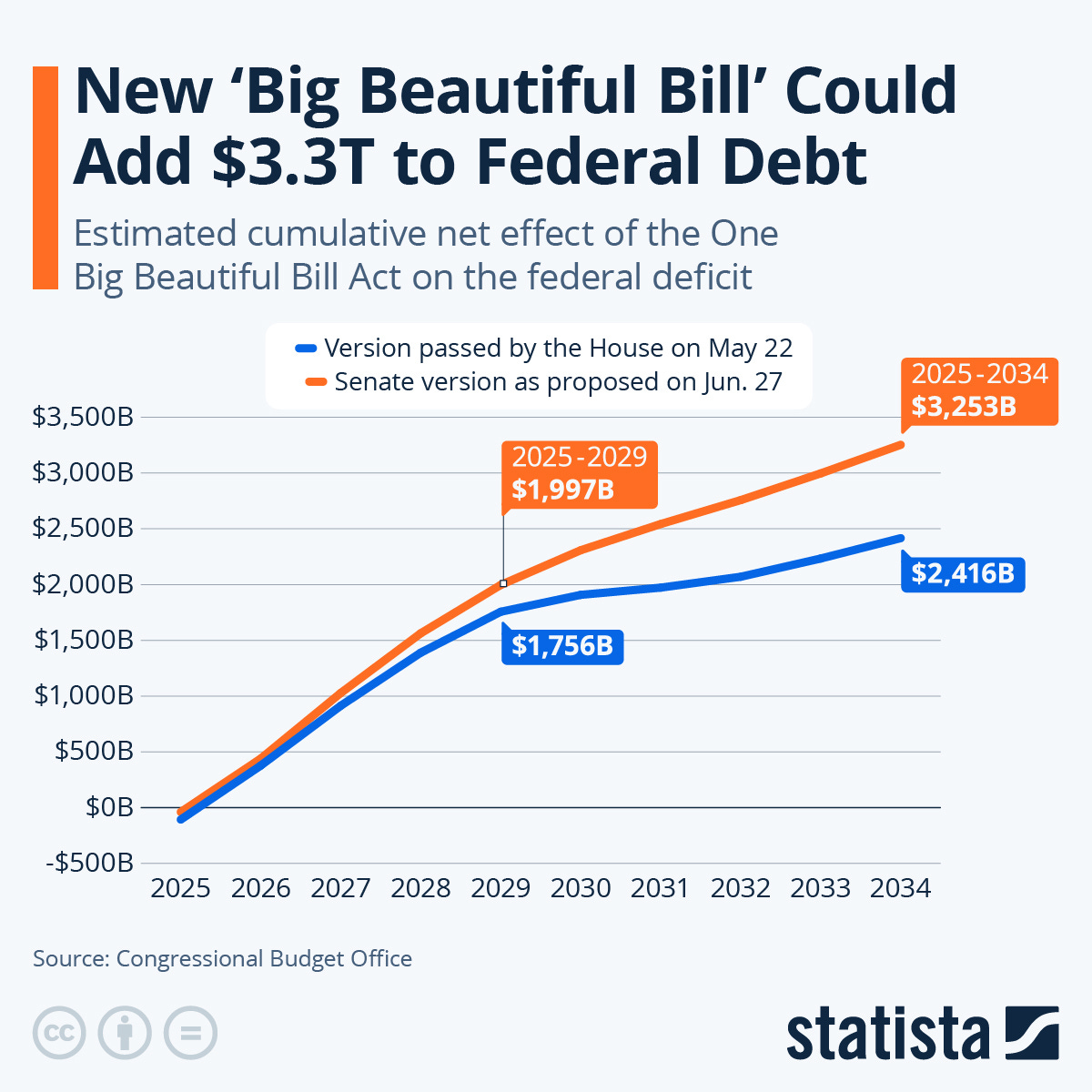

Trillions in national debt: Even after drastically cutting social programs, the BUB is not a balanced spending bill because of massive tax cuts for the ultra-wealthy. The budget overspends by $2.4 trillion, adding over $3 trillion, including interest, to the national debt. Our total national debt will be around $40 trillion in a few years if we follow this spending trend. The current national debt is $36 6 trillion, which is around $107,000 for each U.S. citizen.

Good Ideas, Poor Execution

No tax on tips or overtime. Some benefits for families and seniors: Until 2028, workers can deduct $25,000 from tips on their taxes. This includes all tips, even across multiple tipped jobs. Workers can also deduct $12,500 in overtime pay. However, taxpayers are ineligible for these deductions if they make over $150,000 per year, or $300,000 for joint filers. The BUB also extends the Child Tax Credit and increases it to $2,200. Seniors will also receive a temporary bonus deduction of $6,000 for individual filers making less than $75,000 or $150,000 for joint filers. These portions of the BUB received bipartisan support since they’ll benefit our working families. They’ll provide targeted relief to taxpayers who need it most and give them some breathing room.

However, these tax breaks will be funded by the massive cuts to Medicaid and SNAP. Seniors and families will get money back, but they’ll pay more out of pocket for health care, groceries and utilities. Instead of providing a $1 trillion tax cut to the nation’s top 1%, we could have used that money to give working families some savings while preserving social services.

You can check out the BUB page on our website at this link.

The “One Big Beautiful Bill” will greatly impact Indiana’s families. As your state legislator, I’m working to address the cuts to social services and programs. If you have any comments, questions or are in need of assistance, you can email my office at h96@iga.in.gov.

In service,

Gregory W. Porter